Understanding Crippling Debt – A Complete Guide

What is crippling debt? How do you spiral into this deep hole? Most importantly, how do you get out of it?

First, let’s define crippling debt

Homer consumed a little too much

Homer consumed a little too much

What you (likely) think it is

The common misconception with crippling debt is that it’s driven by compulsive consumerism. Think about the type of consumerism where you acquire a bunch of personal loans and credit cards in order to fulfill consumption impulses. For instance, you get the latest smartphone, go on an extended holiday, and buy a new set of wheels all without the means to reimburse those loans.

This is a cliché about the crippling debt spiral, nevertheless these situations exist and shouldn’t if lenders did their job properly by handing out credit responsibly. But, we’ll get back to this.

What it (actually) is

Life is paved with obstacles in South Africa or anywhere else in the world, and sometimes, setbacks happen. Over-indebted situations develop when the fixed costs of a household are higher than its income.

A regular error is to think that income is fixed (revenue won’t change in the foreseeable future) and costs can be adjusted. But when revenue drops (for example, if you lose your job unexpectedly during a pandemic or when you lose variable income because you didn’t hit your company’s target), your fixed costs won’t necessarily go down.

Let’s dive a little deeper into a typical household income and expenditure structure:

Household income structure: A household’s income is made of the salaries earned by the family members, the capital income earned from a savings account, for example, and any government aid received.

Household expenditure: Expenses are either fixed or variable. Fixed expenses are costs that cannot be easily reduced. These are housing rental payments or mortgage repayments, utility bills, and taxes. Variable costs, on the other hand, are easier to cut back on when income diminishes.

When the income of a household decreases, it needs to adapt expenditures by lowering living expenses or discretionary spendings. Examples of such cost-cutting measures may include buying cheaper clothes or food, not going on holidays, etc.

This is the critical moment when a household can fall into financial traps and a crippling debt spiral if there’s no emergency fund or sound financial advice.

3 key variables to consider when the household’s income decreases

Variable 1: Time

Imagine your household’s income just dropped, but you anticipate a recovery after a certain period of time. Your strategy, therefore, is based on an assumption, and the risk here is misjudging the length of time it will take to recover lost revenue.

Let’s say, you use your savings and lower your everyday expenses to adjust your spendings. But as time goes by, you’re still not recovering your lost income. Perhaps you’re not reaching your targets, or your job interviews haven’t resulted in you getting a new job.

In any case, the more you anticipate your situation to get better fast (after all, you’ve had 6 interviews with recruiters, one has got to result in a job offer!) the more tempted you will be to take out a loan in order to compensate for your diminishing savings and everyday expenses. But in doing so, you’ve just stuck your finger into the first stage of over-indebtedness.

If you took out a loan and your situation doesn’t improve, you will still be required to pay it back. You might even be tempted to take out another loan to pay for the first one. This is how a crippling debt situation deepens.

Variable 2: Budget adaptation

As seen above, when faced with an income drop, households reduce their everyday expenses (food, leisure, etc.) accordingly. The pitfall here is failing to realise how the cut back on spending habits may be a difficult change to cope with.

This variable is obviously closely linked to the time variable (how long this situation of income loss is going to last).

Tightening your belt can only last for so long. If the situation doesn’t evolve positively, the whole family might start suffering from it. Kids can’t go on their usual school trips or get the latest trendy sneakers. They begin to resent you for it, arguments are more frequent, and stress starts creeping in.

The issue here is the pain caused by a diminishing standard of living and the fading hope that the situation will get better soon.

At a certain point, you give in. The youngest keeps complaining, they absolutely need a new laptop to keep studying from home, so you decide to take out a revolving loan to buy the much-needed device.

Variable 3: Mishaps

Unforeseen events happen all the time in our everyday lives. But their effects can be particularly crippling when in a situation of financial stress. When you already have a tight budget, the last thing you need is a car that breaks down, or a water leak in the ceiling, or your computer dying, or an urgent boiler maintenance, etc.

In order to cover these unforeseen costs, you may need to rely greatly on your savings account. The situation gets out of hand when the savings dry out, and the overdraft capacity of your everyday account is maxed out.

The temptation is great to take out a loan to get some breathing space.

Now that we understand how people can become over-indebted, let’s take a look at how interest rates work.

Understanding how interest rates work and their impact on your finances

Let’s take a practical example:

Say you take out a loan for R12,000 at an annual interest rate of 15% over 12 months.

The mistake often made when calculating how much the loan is going to cost is to simply take 15% of 12,000 (1,800) and add it to 12,000 (13,800). This method is incorrect because it doesn’t factor in a crucial element: time (i.e. over what period of time the loan will need to be reimbursed).

Here’s the correct way to approach it:

The interest for the first month is calculated as follows:

[0.15 ÷ 12] × 12,000 = R150

With each monthly payment, you reduce the balance on the loan. After six months, you are left with paying off R6,000. That means the interest you pay for that month is as follows:

[0.15 ÷ 12] × 6,223.50 = R78

As you can see, the interest rate remains the same, but the interest payment is now lower. This adjustment is made until you finish paying off the loan. So, if you’re now left with only R1,000 to pay off, the interest will be:

[0.15 ÷ 12] × 1,000 = R12.5

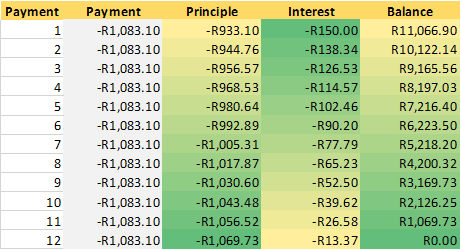

Example of a R12,000 loan repayment plan over 12 months.

Example of a R12,000 loan repayment plan over 12 months.

Above is an example of a credit repayment plan. In the early repayment period, you spend more on interest and less on reimbursing the principal amount. This situation reverses as you progress through the repayments.

Revolving Credit

What are revolving loans?

The bank or lender makes a certain amount of money available to you, and you can use this amount entirely or only parts of it when you want it, how you want it. Like a regular loan, you need to pay back the borrowed amounts every month with interest on top.

The trick here is that this money is always there, available at any time for your use. Think of it as a cookie jar, full of yummy cookies, sitting quietly on your kitchen table-top. It’s tough to resist the temptation to eat one (if not the entire jar). And if this jar automatically refills without you having to go to the shop to buy more, then here comes trouble.

The revolving loan is this cookie jar but filled with money. And the more a household is stressed financially, the more it will be tempted to dig in.

To make matters worse, interest rates on revolving loans are astronomical. The rationale behind this is that the smaller a loan amount, the higher the interest rate. And as the borrowed amounts are small, the interest payments will appear small as well. But appearances can be deceiving.

Repaying R1,000 at 20% interest rate over one year equates to R96 total interest, overall. Which, in turn, translates to R8 per month. Looks affordable, right?

To sum up, revolving loans can easily become the equivalent of the banana peel that pushes you off-track if you don’t watch your steps carefully.

Why do lenders offer revolving credit?

In order to understand this, let’s take a practical example.

Say you are a lending company that offers revolving credit. Your data shows that, as a rule of thumb, out of 100 clients you grant a loan to, on average:

- 80 will reimburse you.

- 15 will need a nudge in order to reimburse you.

- 5 will default on their credit, i.e. will never pay you back.

The problem is that when a new client applies for a loan, you don’t know in which of the 3 above categories they will fall.

In order to get a better understanding of each individual situation, you need to hire a customer advisor who is a financial specialist. This advisor will take time to study each customer’s application and situation in order to determine which financial product best fits their needs. In an ideal world, this financial advisor would detect early on the situations where people start accumulating too many debts and offer them help.

The issue is that a financial advisor costs a lot of money to lenders. As a result, many of them use statistical analysis. Most loan requests are accepted, and maximum interest rates are charged to consumers. The profit made on the 80 people who will repay their loan is more than enough to cover the losses generated by the people who default.

To handle the people who need a nudge, a part-time worker on minimum wage in charge of hassling them on the phone or via email will do the job.

A quick philosophical thought: Goodhart’s Law applied to revolving credit lenders

Goodhart’s law is an adage which says that when a measure becomes a target, it ceases to be a good measure.

Say what? Let me explain.

Originally, a company does not exist to make a profit but to sell goods and services to people who need them. In doing so, the company will turn a profit. But profits should always be a means, not an end. When a company places profits above everything else as a target, chances are, it’s going to lose sight of its initial purpose. That’s what loan sharks and reckless creditors do, by granting loans to people who can’t afford them.

To sum up what we’ve covered so far:

- Crippling debt is not only linked to over-consumption but mostly to a loss of income.

- When a life setback happens, the risk is to under-estimate the time it will take to recover.

- Stress starts building up when our standard of living decreases and mishaps add to our financial stress.

- In this situation, revolving credit is the banana peel disguised as a lifebuoy that lenders will throw at you in order to maximise their profits.

How to overcome crippling debt

There is no shame in being over-indebted

Loans are an integral part of the economy. One person’s expenditure is another’s income. People who are in debt contribute actively to making the world go round. Without their need for extra cash, many would be jobless.

Crippling debt is a complex problem that can be tied to the growing income discrepancies within society. Production of goods and services is on the rise, but the vast majority of people don’t benefit from sufficient income to enjoy those new goods and services.

In order to compensate for these discrepancies, loans and credit facilities were invented. But with debt comes default risk.

Anyone can make bad decisions

It’s easy to find yourself the unwitting prey of predatory lending companies. These companies have well-oiled marketing and sales campaigns that will make you think that obtaining a loan is going to be the solution to all your problems.

Most of us will make it a question of honour to repay a debt. But as much as paying back money owed to friends and family members is important, as the funds come from their own pockets, it’s a bit different with banks since they don’t lend you their own money. Instead, they use “money machines” to grant you loans. Furthermore, interest rates exist, in part, to cover default risks. Therefore and at the end of the day, defaulting on a loan is sad, but it shouldn’t be considered disgraceful.

Being in a bad debt situation means you’re going to fight existing rules. These rules can be adapted to your specific situation, in order to give you breathing space and time to sort things out. The bottom line is: There is always a solution.

No mountain is too high

No mountain is too high

Which solutions are available to get out of a crippling debt situation?

Seeking help

As seen above, it’s possible to take out a loan without speaking to anyone. Fortunately, it’s also possible to speak with real humans about your money problems. Such humans can be:

- Your bank’s financial advisor

- Social workers

- NCR (National Credit Regulator) registered debt counsellors

- Financial Advice and Intermediary Services Ombud (FAISO)

These organisations are experts and know the ins and outs of financial planning. They possess a sound understanding of the levers that can be used to improve your situation.

They can help you:

- Assess your situation. Is there a chance your new situation (loss of income) is going to be permanent?

- Organise your expenses. Which expenses need to be maintained in order for the household to endure the situation as best as possible?

- Reduce borrowing costs. Which fees seem unavoidable, but actually are, if you read the fine prints?

- Prepare for unforeseen incidents. What’s the best way to budget for mishaps if you want to avoid the pitfall of over-indebtedness?

They can also act as mediators between you and the lender to renegotiate interest rates and/or lengthen the repayment period in order to reduce your monthly repayments. What’s more, they can even help you find a debt consolidation loan, which will group all your credit accounts into a single loan, thus, making the management of your debt easier.

The most important thing to understand here is that during this process, you will be placed under debt review. Being placed under debt review or a credit relief program means you are protected by the National Credit Act, and your creditors will no longer be authorised to hassle you.

Debt review is a great way to get out of a dire debt situation. But it’s a “last resort” option. As soon as a crippling debt situation arises, one needs to seek advice from the financial specialists mentioned above.

Latest posts

Why was my loan application rejected?

23.08.2020

What is loan refinancing and why you should care

23.09.2020

What is financial responsibility and how to achieve it

24.11.2020